| | | | |

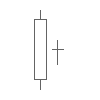

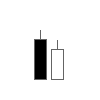

| Bearish Harami Consists of an unusually large white body followed by a small black body (contained within a large white body). It is considered a bearish pattern when preceded by an uptrend. | | Bearish Harami Cross A large white body followed by a Doji. Considered a reversal signal when it appears at the top. |

| | | | |

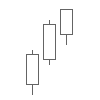

| Bearish 3-Method Formation A long black body followed by three small bodies (normally white) and a long black body. The three white bodies are contained within this jedi range of the first black body. This is considered a bearish continuation pattern. | | Bullish 3-Method Formation Consists of a long white body followed by three small bodies (normally black) and a long white body. The three black bodies are contained within the range of first white body. This is considered a bullish continuation pattern. |

| | | | |

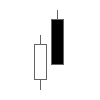

| Bullish Harami Consists of an unusually large black body followed by a small white body (contained within large black body). It is considered a bullish pattern when preceded by a downtrend. | | Bullish Harami Cross A large black body followed by a Doji. It is considered a reversal signal w |

| Dark Cloud Cover Consists of a long white candlestick followed by a black candlestick that opens above the high of the white candlestick and closes well into the body of the white candlestick. It is considered a bearish reversal signal during an uptrend. | | Engulfing Bearish Line Consists of a small white body that is contained within the following large black candlestick. When it appears at the top it is considered a major reversal signal. |

| | | | |

| U | Engulfing Bullish Consists of a small black body that is contained within the following large white candlestick. When it appears at the bottom it is interpreted as a major reversal signal. | | Evening Doji Star Consists of three candlesticks. First is a large white body candlestick followed by a Doji that gaps above the white body. The third candlestick is a black body that closes well into the white body. When it appears at the top it is considered a reversal signal. It signals a more bearish trend than the evening star pattern because of the Doji that has appeared between the two bodies. |

| | | | |

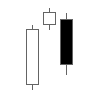

| Evening Star Consists of a large white body candlestick followed by a small body candlestick (black or white) that gaps above the previous. The third is a black body candlestick that closes well within the large white body. It is considered a reversal signal when it appears at the top level. | | Falling Window A window (gap) is created when the high of the second candlestick is below the low of the preceding candlestick. It is considered that the window should be filled with a probable resistance. |

| | | | |

| Morning Doji Star Consists of a large black body candlestick followed by a Doji that occurred below the preceding candlestick. On the following day, a third white body candlestick is formed that closes well into the black body candlestick which appeared before the Doji. It is considered a major reversal signal that is more bullish than the regular morning star pattern because of the existence of the Doji. | | Morning Star Consists of a large black body candlestick followed by a small body (black or white) that occurs below the large black body candlestick. On the following day, a third white body candlestick is formed that closes well into the black body candlestick. It is considered a major reversal signal when it appears at the bottom. |

| | | | |

| On Neckline In a downtrend, consists of a black candlestick followed by a small body white candlestick with its close is near the low of the preceding black candlestick. It is considered a bearish pattern when the low of the white candlestick is penetrated. | | Three Black Crows Consists of three long black candlesticks with consecutively lower closes. The closing prices are near to or at their lows. When it appears at the top it is considered a top reversal signal. |

| | | | |

| Three White Soldiers Consists of three long white candlesticks with consecutively higher closes. The closing prices are near to or at their highs. When it appears at the bottom it is interpreted as a bottom reversal signal. | | Tweezer Bottoms Consists of two or more candlesticks with matching bottoms. The candlesticks may or may not be consecutive and their sizes or colours can vary. It is considered a minor reversal signal that becomes more important when the candlesticks form another pattern. |

| | | | |

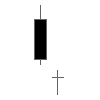

| Tweezer Tops Consists of two or more candlesticks with matching tops. The candlesticks may or may not be consecutive and their sizes or colours can vary. It is considered a minor reversal signal that becomes more important when the candlesticks form another pattern. | | Doji Star Consists of a black or white candlestick followed by a Doji that gaps above or below these. It is considered a reversal signal with confirmation during the next trading day. |

| | | | |

| Piercing Line Consists of a black candlestick followed by a white candlestick that opens lower than the low of the preceding but closes more than halfway into the black body candlestick. It is considered a reversal signal when it appears at the bottom. | | Rising Window A window (gap) is created when the low of the second candlestick is above the high of the preceding candlestick. It is considered that the window should provide support to the selling pressure. |

| | | | |

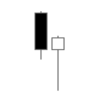

| Judas Candle Consists of a large black candle followed by a smaller white candle with a lower tail which is equal to the black candle in length. This is indicative of price capitulation. | | Darth Maul The correct term for this candle is a "high wave spinning top", a small candle body with unusually large upper and lower shadows, suggesting that the prior trend has run into a period of indecision. The term "Darth Maul" comes from Star Wars, as the candle looks somewhat like a lightsaber. |

Comments

Post a Comment