Types of chart patterns

Traditional Chart Pattern

Included in this type are the most common patterns which have been introduced to chartists for more than a hundred years. Below is a list of the most commonly used traditional chart patterns:

Reversal Patterns:

- Double Top Reversal

- Double Bottom Reversal

- Triple Top Reversal

- Triple Bottom Reversal

- Head and Shoulders

- Key Reversal Bar

Continuation Patterns:

- Triangle

- Flag and Pennant

- Channel

- Cup with Handle

Harmonic Pattern

Harmonic Pattern utilizes the recognition of specific structures that possess distinct and consecutive Fibonacci ratio alignments that quantify and validate harmonic patterns. These patterns calculate the Fibonacci aspects of these price structures to identify highly probable reversal points in the financial markets. This methodology assumes that harmonic patterns or cycles, like many patterns and cycles in life, continually repeat. The key is to identify these patterns and to enter or to exit a position based upon a high degree of probability that the same historic price action will occur.

Below is a list of commonly used harmonic patterns:

- Bat

- Butterfly

- Gartley

- Cypher

- Crab

- Deep Crab

- Shark

- 3 Drives

- AB=CD

- 5-0

Traders use the Potential Reversal Zone (PRZ) as an important level of support/resistance in their trading and price action strategy.

Broadening top

In the broadening top formation five minor reversals are followed by a substantial decline.

In the figure above, price of the share reverses five times, reversal point d is made at a lower point than reversal point b and reversal point c and e occur successively higher than reversal point a.

One can't be sure of the trend unless price breaks down the lower of the two points (b & d) and keeps on falling. In the figure below, Broading Top is confirmed.

Double top

The double top is a frequent price formation at the end of a bull market. It appears as two consecutive peaks of approximately the same price on a price-versus-time chart of a market. The two peaks are separated by a minimum in price, a valley. The price level of this minimum is called the neck line of the formation. The formation is completed and confirmed when the price falls below the neck line, indicating that further price decline is imminent or highly likely.

The double top pattern shows that demand is outpacing supply (buyers predominate) up to the first top, causing prices to rise. The supply-demand balance then reverses; supply outpaces demand (sellers predominate), causing prices to fall. After a price valley, buyers again predominate and prices rise. If traders see that prices are not pushing past their level at the first top, sellers may again prevail, lowering prices and causing a double top to form. It is generally regarded as a bearish signal if prices drop below the neck line.

The time between the two peaks is also a determining factor for the existence of a double top pattern. If the tops appear at the same level but are very close in time, then the probability is high that they are part of the consolidation and the trend will resume.

Volume is another indicator for interpreting this formation. Price reaches the first peak on increased volume then falls down the valley with low volume. Another attempt on the rally up to the second peak should be on a lower volume.

Double bottom

A double bottom is the end formation in a declining market. It is identical to the double top, except for the inverse relationship in price. The pattern is formed by two price minima separated by local peak defining the neck line. The formation is completed and confirmed when the price rises above the neck line, indicating that further price rise is imminent or highly likely.

Most of the rules that are associated with double top formation also apply to the double bottom pattern. Volume should show a marked increase on the rally up while prices are flat at the second bottom.

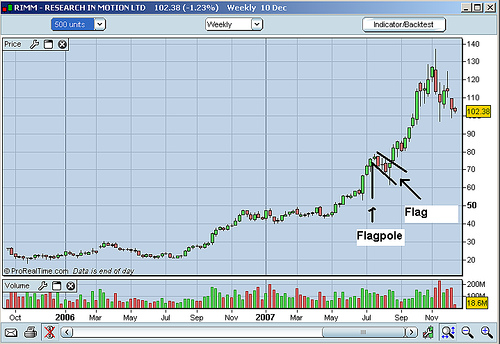

Flag pattern

The flag pattern is encompassed by two parallel lines. These lines can be either flat or pointed in the opposite direction of the primary market trend. The pole is then formed by a line which represents the primary trend in the market. The pattern, which could be bullish or bearish, is seen as the market potentially just taking a "breather" after a big move before continuing its primary trend. The chart below illustrates a bull flag. A bear flag would trend in the opposite direction.

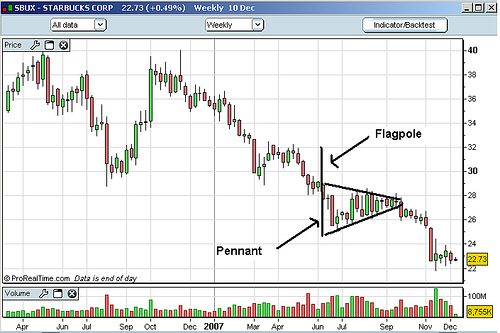

Pennant pattern

A classic pattern for technical analysts, the pennant pattern is identifiable by a large price move, followed by a continuation period and a breakout. The pattern resembles a flagpole. The pennant phase is identified by an initial large price movement indicating high volume transactions, followed by weaker price movement indicating low volume transactions. Traders earn by capitalizing on the breakout phase. The pennant pattern is identical to the flag pattern in its setup and implications; the only difference is that the consolidation phase of a pennant pattern is characterized by converging trend lines rather than parallel trend lines.

Head and shoulders top

Head and Shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. The left shoulder is formed at the end of an extensive move during which volume is noticeably high. After the peak of the left shoulder is formed, there is a subsequent reaction and prices slide down somewhat, generally occurring on low volume. The prices rally up to form the head with normal or heavy volume and subsequent reaction downward is accompanied with lesser volume. The right shoulder is formed when prices move up again but remain below the central peak called the Head and fall down nearly equal to the first valley between the left shoulder and the head or at least below the peak of the left shoulder. Volume is lesser in the right shoulder formation compared to the left shoulder and the head formation. A neckline can be drawn across the bottoms of the left shoulder, the head and the right shoulder. When prices break through this neckline and keep on falling after forming the right shoulder, it is the ultimate confirmation of the completion of the Head and Shoulders Top formation. It is quite possible that prices pull back to touch the neckline before continuing their declining trend.

Head and Shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. The left shoulder is formed at the end of an extensive move during which volume is noticeably high. After the peak of the left shoulder is formed, there is a subsequent reaction and prices slide down somewhat, generally occurring on low volume. The prices rally up to form the head with normal or heavy volume and subsequent reaction downward is accompanied with lesser volume. The right shoulder is formed when prices move up again but remain below the central peak called the Head and fall down nearly equal to the first valley between the left shoulder and the head or at least below the peak of the left shoulder. Volume is lesser in the right shoulder formation compared to the left shoulder and the head formation. A neckline can be drawn across the bottoms of the left shoulder, the head and the right shoulder. When prices break through this neckline and keep on falling after forming the right shoulder, it is the ultimate confirmation of the completion of the Head and Shoulders Top formation. It is quite possible that prices pull back to touch the neckline before continuing their declining trend.

Head and shoulders bottom

This formation is simply the inverse of a Head and Shoulders Top and often indicates a change in the trend and market sentiment. The formation is upside down and the volume pattern is different from a Head and Shoulder Top. Prices move up from first low with increase volume up to a level to complete the left shoulder formation and then fall down to a new low. A recovery move follows that is marked by somewhat more volume than seen before to complete the head formation. A corrective reaction on low volume occurs to start formation of the right shoulder and then a sharp move up due to heavier volume again breaks though the neckline.

Another difference between the Head and Shoulders Top and Bottom is that the Top Formations are completed in a few weeks, whereas a Major Bottom (left, right shoulder or the head) usually takes longer, and as observed, may be prolonged for a period of several months or sometimes even more than a year.

This formation is simply the inverse of a Head and Shoulders Top and often indicates a change in the trend and market sentiment. The formation is upside down and the volume pattern is different from a Head and Shoulder Top. Prices move up from first low with increase volume up to a level to complete the left shoulder formation and then fall down to a new low. A recovery move follows that is marked by somewhat more volume than seen before to complete the head formation. A corrective reaction on low volume occurs to start formation of the right shoulder and then a sharp move up due to heavier volume again breaks though the neckline.

Another difference between the Head and Shoulders Top and Bottom is that the Top Formations are completed in a few weeks, whereas a Major Bottom (left, right shoulder or the head) usually takes longer, and as observed, may be prolonged for a period of several months or sometimes even more than a year.

Importance of neckline

The neckline drawn on the pattern represents a support level, it cannot be assumed that a Head and Shoulder formation is complete unless the support level is broken. Such breakthrough may happen to be on greater volume or may not. Breakthroughs should be observed with great care. Serious drops can occur if a breakthrough is more than three to four percent.

When a stock drifts through the neckline on small volume, there may also be a wave up in some cases, although it has been observed that such a rally normally will not cross the general level of the neckline before selling pressure increases and a steep decline occurs, after which prices may due to greater volume.

The neckline drawn on the pattern represents a support level, it cannot be assumed that a Head and Shoulder formation is complete unless the support level is broken. Such breakthrough may happen to be on greater volume or may not. Breakthroughs should be observed with great care. Serious drops can occur if a breakthrough is more than three to four percent.

When a stock drifts through the neckline on small volume, there may also be a wave up in some cases, although it has been observed that such a rally normally will not cross the general level of the neckline before selling pressure increases and a steep decline occurs, after which prices may due to greater volume.

Characteristics

- Most of the time Head and Shoulders are not perfectly shaped. This formation is slightly tilted upward or downward.

- One shoulder may appear to droop.

- On many chart patterns, any one of the two shoulders may appear broader than the other which is caused by the time involved in the formation of the valleys.

- The neckline may not be perfectly horizontal; it may be ascending or descending.

- If the neckline is ascending then to qualify as a Head and Shoulders formation the lowest point of the right shoulder must be noticeably lower than the peak of the left shoulder.

- Most of the time Head and Shoulders are not perfectly shaped. This formation is slightly tilted upward or downward.

- One shoulder may appear to droop.

- On many chart patterns, any one of the two shoulders may appear broader than the other which is caused by the time involved in the formation of the valleys.

- The neckline may not be perfectly horizontal; it may be ascending or descending.

- If the neckline is ascending then to qualify as a Head and Shoulders formation the lowest point of the right shoulder must be noticeably lower than the peak of the left shoulder.

Usage as a tool

Head and Shoulders is a useful tool after its confirmation to estimate and measure the minimum probable extent of the subsequent move from the neckline. To find the distance of subsequent move, measure the vertical distance from the peak of the head to the neckline. Then measure this same distance down from the neckline beginning at the point where prices penetrate the neckline after the completion of the right shoulder. This gives the minimum objective of how far prices can decline after the completion of this top formation.

If the price advance preceding the Head and Shoulders top is not long, the subsequent price fall after its completion may be small as well.

Head and Shoulders is a useful tool after its confirmation to estimate and measure the minimum probable extent of the subsequent move from the neckline. To find the distance of subsequent move, measure the vertical distance from the peak of the head to the neckline. Then measure this same distance down from the neckline beginning at the point where prices penetrate the neckline after the completion of the right shoulder. This gives the minimum objective of how far prices can decline after the completion of this top formation.

If the price advance preceding the Head and Shoulders top is not long, the subsequent price fall after its completion may be small as well.

Triple top

Formation

The formation of triple tops is rarer than that of double tops in the rising market trend. The volume is usually low during the second rally up and lesser during the formation of the third top. The peaks may not necessarily be spaced evenly like those which constitute a Double top. The intervening valleys may not bottom out at exactly the same level, i.e. either the first or second may be lower. The triple top is confirmed when the price decline from the third top falls below the bottom of the lowest valley between the three peaks.

Selling strategy

There are several different trading strategies that can be employed to take advantage of this formation. Of course, first and second peaks are perfect point to place sell orders. After the double top has been confirmed and if prices are moving up again with low volume, it is an opportune point to sell. One can sell short with a stop (calculated loss) above the highest peak of the Double top. The next opportune point to sell would be after a Triple top has formed and a fourth top is being formed at the lower level.

Formation

The formation of triple tops is rarer than that of double tops in the rising market trend. The volume is usually low during the second rally up and lesser during the formation of the third top. The peaks may not necessarily be spaced evenly like those which constitute a Double top. The intervening valleys may not bottom out at exactly the same level, i.e. either the first or second may be lower. The triple top is confirmed when the price decline from the third top falls below the bottom of the lowest valley between the three peaks.

Selling strategy

There are several different trading strategies that can be employed to take advantage of this formation. Of course, first and second peaks are perfect point to place sell orders. After the double top has been confirmed and if prices are moving up again with low volume, it is an opportune point to sell. One can sell short with a stop (calculated loss) above the highest peak of the Double top. The next opportune point to sell would be after a Triple top has formed and a fourth top is being formed at the lower level.

Triple bottom

Most of the rules that are applied in the formation of the triple top can be reversed in the formation of triple bottom. As far as volume is concerned, the third low bottom should be on low volume and the rally up from that bottom should show a marked increase in activity.

The formation of Triple bottom occurs during the period of accumulation.

Most of the rules that are applied in the formation of the triple top can be reversed in the formation of triple bottom. As far as volume is concerned, the third low bottom should be on low volume and the rally up from that bottom should show a marked increase in activity.

The formation of Triple bottom occurs during the period of accumulation.

Comments

Post a Comment